Barrick’s DRC gold mine is exemplary global advancer of African greenness, automation

Barrick presentation covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

Barrick in Africa.

Barrick in DRC, Zambia, Tanzania.

Photo by Creamer Media

JOHANNESBURG (miningweekly.com) – Africa received a strong thumbs-up during the second-quarter presentation of Barrick as one of its “main cash generators”.

“We saw solid performance across the portfolio,” Barrick CEO Dr Mark Bristow outlined at the event covered by Mining Weekly. (Also watch attached Creamer Media video.)

The New York- and Toronto-listed gold and copper mining company’s ongoing organic growth advances included another strong quarter with higher production and improved unit costs across the board, supported in part by a reduction in sustaining capital.

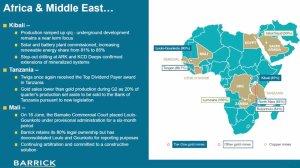

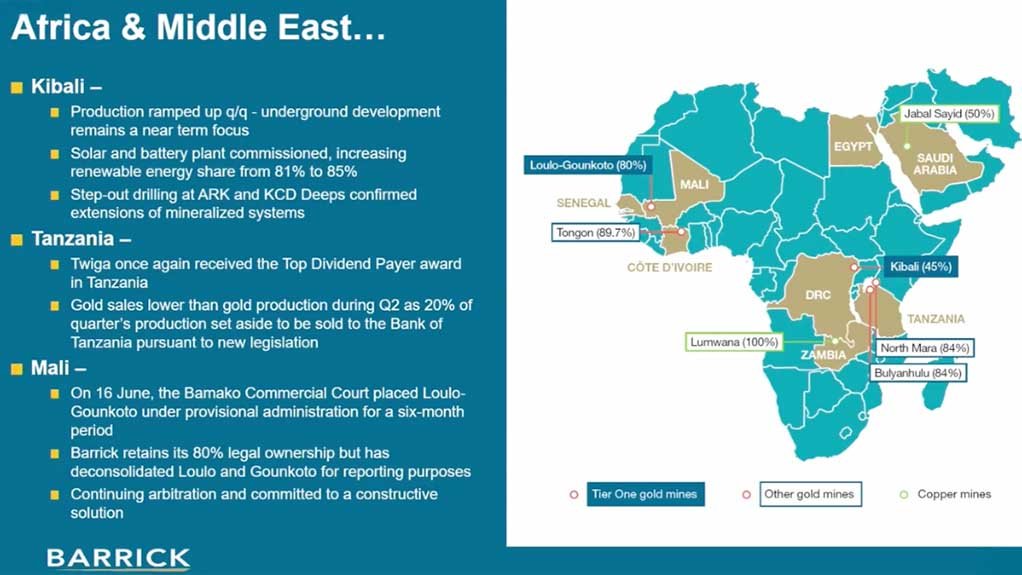

The three months to June 30 came with encouraging improvements at the Barrick-operated Kibali, the gold mine in the north-east of Africa’s Democratic Republic of Congo (DRC) which is owned by Kibali Goldmines SA, a joint venture company owned 45% by each of Barrick and AngloGold Ashanti, and 10% by Société Miniére de Kilo-Moto (SOKIMO).

While Kibali is headlined as Africa’s largest gold mine, popping up with increasing regularly it is also a global contender as one of the world’s greenest and most automated gold mines while continuing to contribute to the Congolese economy with in-country investment now surpassing $6.3-billion, which included $3.1-billion in payments to local contractors and partners. The mine remains the single biggest economic contributor to the north-eastern DRC, spanning the Haut-Uele and Ituri provinces.

On the environmental protection front, Bristow was also able to report the commissioning of a solar power plant and battery energy storage system, which the DRC’s hydropower has already elevated sky-high as a clean power operator.

Now, the sun is further strengthening Kibali’s position as one of the greenest gold mines in the world and also as one of the most automated in the world.

When South Africa-born Bristow began building Kibali 15 years ago, the region was one of the DRC’s most underdeveloped but the value created and the infrastructure built there has since transformed the region into a new economic frontier and a flourishing commercial hub.

Moreover, work with the Congolese Institute for Nature Conservation and African Parks has resulted in the DRC’s Garamba National Park becoming synonymous with white rhino, the most social of all rhino species.

Bristow also highlighted how Africa’s Tanzania delivered “another on-track quarter with North Mara continuing its steady performance”.

At Tanzania’s Bulyanhulu, expansion is continuing with a spotlight on a second access and production area to support future growth. With associated royalty reduction benefit, Barrick is adapting to the new legislation that is being implemented in Tanzania, which requires 20% of gold production to be reserved for in-country trading.

In Zambia, copper progress at the Lumwana Super Pit Expansion is exciting Barrick amid the operation continuing on a steady upward trajectory, with year-on-year and quarter-on-quarter increases in production and a positive reduction across all key metrics. The Lumwana Super Pit Expansion is not only well on track but has so far this year funded itself through operating cash flows, which Bristow expects will continue for the rest of the year at current spot prices.

Once complete, the expanded Lumwana is expected to deliver 240 000 t/y of copper, supported by a 52-million-ton-a-year processing plant and a mine life of more than 30 years.

Last year, Lumwana’s second quarter copper production was 25 000 t compared with this year’s second-quarter production of a far higher 44 000 t.

With this production surge has come a commensurate drop in the unit cost per pound of copper and all-in sustaining costs.

Drawing attention to the Lumwana slide showing production up 63%, cash costs down 29%, and the second-quarter run rate poised to persist, Bristow said: “It's very material, and that's where our focus is.

“Lumwana is a mine that never made a profit until 2020 and we need the all-in sustaining cost (AISC) to be under $3/lb and then that proves our feasibility model extremely well.

“As you know, there are not many copper mines capable of delivering a minus $3/lb AISC.

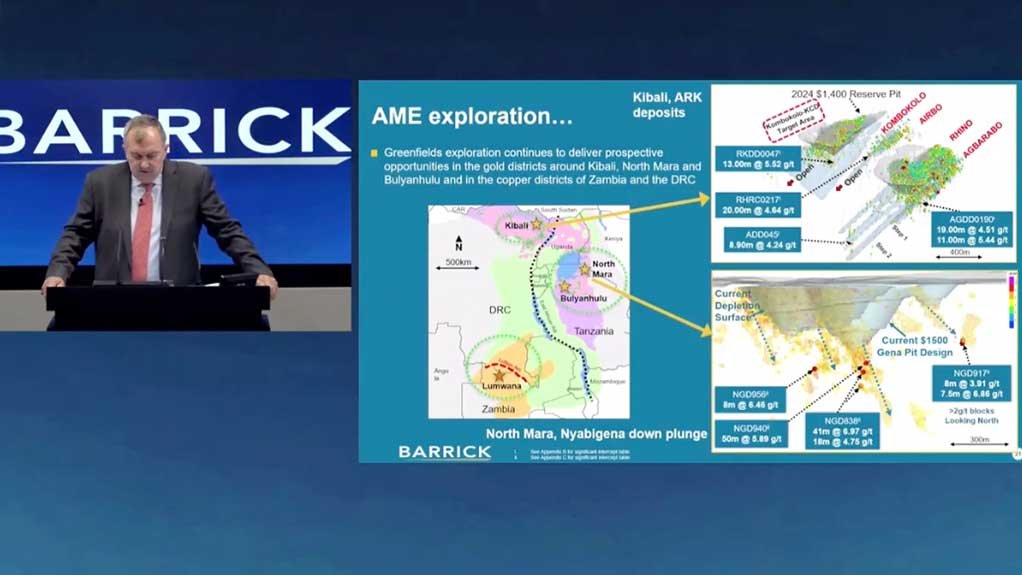

“Again this year, Africa and the Middle East remains well positioned to replace reserve depletion, a hallmark of the region over the many years that has been operating.

“We continue to advance near-mine exploration with standout progress along the ARK corridor at Kibali, with drilling extending mineralised loads and confirming significant exploration upside. ARK is right next to the main KCD orebody, which is the real basis of Kibali’s value.

“Greenfield programmes are also progressing across the region in Tanzania, the DRC, and across the Central African copperbelt, which spans both southern DRC and Zambia.

“In addition, we continue to advance our early-stage exploration in Saudi Arabia, further reinforcing the depths of our pipeline across this region.

“While we continue to work towards a solution for Loulo-Gounkoto, it’s important to note that even without it, the underlying value of our portfolio still significantly exceeds our market value,” Bristow pointed during the presentation covered by Mining Weekly.

In Mali, Barrick is continuing to manage the situation in what it describes as “a measured and constructive manner”.

The New York- and Toronto-listed company is continuing with arbitration amid its stated commitment to find a path forward “for the benefit of all stakeholders”.

“For those of you tracking updates closely, I encourage you to visit the microsite we recently added to our website,” Bristow urged.

The Loulo-Gounkoto complex comprises two distinct mining permits, Loulo and Gounkoto, and is situated in western Mali, bordering Senegal and adjacent to the Falémé river.

Société des Mines de Loulo SA (Loulo) owns the Loulo gold mine, and Société des Mines de Gounkoto (Gounkoto) owns the Gounkoto gold mine. Both Loulo and Gounkoto are owned by Barrick (80%), and the State of Mali (20%).

“Our relationship with Mali represents more than a business partnership — it exemplifies the shared value creation that has defined our approach to responsible mining across Africa and around the world,” is how Bristow sees it.

“Every day we continue to work toward a resolution that serves the best interests of all. I want to emphasise that Barrick’s position is legally sound and we’re confident in our ultimate success. We have continued to engage in good faith with the government of Mali to finalise an agreement that was fully negotiated and accepted by the Ministry of Finance in February 2025.

“Our Mining Conventions provide binding protections enforceable by way of international arbitration. We have consistently operated with integrity and transparency throughout our decades-long presence in Mali.

“There’s no legal or practical justification for day-to-day operations to be handed over to a court-appointed provisional administrator,” Bristow adds, describing the arbitration case as being built on solid legal foundations and the international oversight process ensuring independent and binding adjudication. We’re not simply hoping for a favourable outcome but pursuing resolution through the proper legal channels,” he adds on the microsite.

ORGANIC GROWTH

Barrick, which is replacing the gold and copper that it mines, is on the way to growing 30% organically by 2029, funded by its own balance sheet.

What it goes for are long-life assets, partnerships, financial stability and exploration excellence.

“In a world searching for real assets, strong partners and responsible growth, Barrick stands apart. Few can match what we offer, and fewer still can do it without debt or dilution,” is the Bristow standpoint.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation